Decoding The Galena Park ISD Payroll Calendar: A Complete Information For Staff

By admin / October 22, 2024 / No Comments / 2025

Decoding the Galena Park ISD Payroll Calendar: A Complete Information for Staff

Associated Articles: Decoding the Galena Park ISD Payroll Calendar: A Complete Information for Staff

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Galena Park ISD Payroll Calendar: A Complete Information for Staff. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Galena Park ISD Payroll Calendar: A Complete Information for Staff

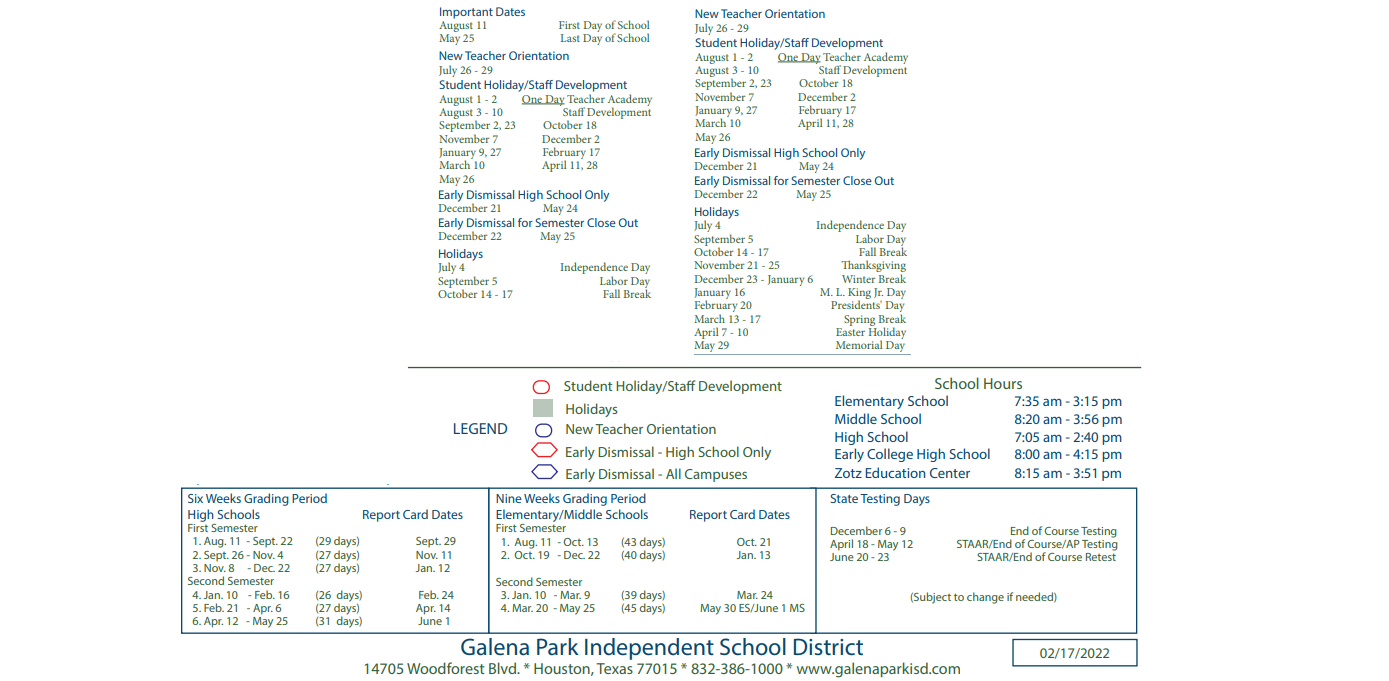

The Galena Park Unbiased Faculty District (GPISD) employs a big workforce devoted to educating and nurturing the scholars inside its neighborhood. Understanding the GPISD payroll calendar is essential for efficient monetary planning for all staff, from seasoned lecturers to newly employed assist workers. This text goals to supply a complete overview of the GPISD payroll schedule, addressing widespread questions, providing ideas for managing funds, and explaining the processes concerned in payroll administration.

Understanding the GPISD Payroll Cycle:

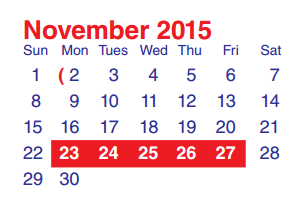

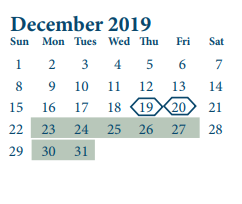

In contrast to some districts with bi-weekly pay cycles, GPISD sometimes operates on a month-to-month payroll schedule. This implies staff obtain their wage funds as soon as a month, often on a selected day of the month. The precise date can differ barely from month to month, primarily as a consequence of weekends and holidays falling inside the pay interval. Due to this fact, merely counting on a earlier 12 months’s calendar is not all the time adequate.

The place to Discover the Official Payroll Calendar:

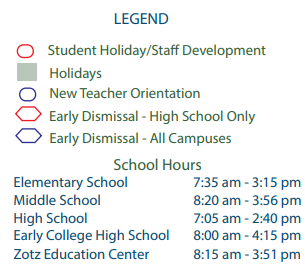

Probably the most dependable supply for the GPISD payroll calendar is the official district web site. The Human Sources (HR) division often publishes this data prominently, typically underneath sections like "Worker Sources," "Payroll," or "Finance." Search for downloadable calendar information (PDFs are widespread) or a clearly displayed schedule outlining the fee dates for the complete 12 months. Inside worker portals additionally continuously present this important data.

Elements Influencing Payroll Dates:

A number of components can have an effect on the exact date of payroll disbursement:

- Weekends: If the scheduled fee date falls on a weekend, the fee will sometimes be issued on the previous Friday.

- Holidays: District-observed holidays also can shift the fee date. If a payroll date coincides with a vacation, the fee is often superior to the Friday earlier than the vacation.

- System Upkeep: Sometimes, unexpected technical points with the payroll system may trigger a slight delay. Nevertheless, the district often communicates any such delays properly prematurely by way of official channels.

- 12 months-Finish Processing: The ultimate payroll of the 12 months may be barely delayed because of the elevated workload related to year-end monetary reporting and tax preparations.

Navigating Payroll Points and Inquiries:

Even with a transparent calendar, questions or issues about payroll may come up. This is handle them successfully:

- Test Your Pay Stub: The pay stub supplies detailed details about your earnings, deductions, and web pay. Overview it rigorously for any discrepancies.

- Contact HR Instantly: The GPISD HR division is the first level of contact for payroll-related queries. Their contact data, together with cellphone numbers and e mail addresses, must be available on the district’s web site.

- Worker Portal: Many districts make the most of on-line worker portals. These portals typically present entry to pay stubs, W-2 varieties, tax data, and different related paperwork. Test your portal repeatedly for updates and knowledge.

- Perceive Your Deductions: Familiarize your self with all deductions out of your paycheck, together with taxes, insurance coverage premiums, retirement contributions, and another voluntary deductions. Contact HR or your payroll division when you have questions on particular deductions.

Monetary Planning with the GPISD Payroll Calendar:

Figuring out your precise payday permits for meticulous monetary planning:

- Budgeting: The month-to-month payroll schedule facilitates constant budgeting. You’ll be able to allocate funds for numerous bills primarily based in your predictable revenue stream.

- Invoice Funds: Schedule invoice funds to align along with your payday to keep away from late charges and preserve good credit score.

- Financial savings Objectives: Constant revenue permits for normal financial savings contributions, whether or not in direction of retirement, emergencies, or different monetary objectives.

- Debt Administration: A predictable revenue stream makes it simpler to handle debt successfully by making a reimbursement plan that aligns along with your payroll schedule.

Significance of Correct Data:

Sustaining correct private data with the GPISD HR division is essential for well timed and correct payroll processing. This consists of:

- Handle Updates: Notify HR instantly of any modifications to your handle to make sure your paycheck is delivered to the proper location.

- Banking Particulars: Maintain your checking account data up to date to keep away from fee delays or points.

- Tax Data: Present correct tax data (W-4) to make sure right tax withholdings.

Influence of Absences and Depart on Payroll:

Absences, comparable to sick depart, trip, or private days, will have an effect on your paycheck. GPISD probably has particular insurance policies concerning pay throughout absences, which must be outlined in worker handbooks or by way of HR. Understanding these insurance policies is essential for correct monetary planning.

Understanding Additional time and Extra Compensation:

GPISD probably has particular insurance policies concerning time beyond regulation pay and different types of further compensation. Understanding these insurance policies is essential for correct calculation of anticipated earnings. Seek the advice of your employment contract or contact HR when you have questions concerning time beyond regulation or different supplemental pay.

12 months-Finish Processes and Tax Paperwork:

On the finish of the 12 months, GPISD will present vital tax paperwork, together with W-2 varieties, that are important for submitting your revenue tax return. These paperwork are often out there by way of the worker portal or will be requested from the HR division. Make sure you obtain your W-2 kind in a well timed method to keep away from delays in submitting your taxes.

Conclusion:

The Galena Park ISD payroll calendar is a key factor within the monetary well-being of its staff. By understanding the payroll cycle, using out there assets, and proactively addressing any questions or issues, GPISD staff can successfully handle their funds and guarantee a easy payroll expertise. Recurrently checking the official district web site and worker portal for updates is essential to remain knowledgeable about any modifications to the payroll schedule and different related data. Proactive communication with the HR division can resolve any points promptly and effectively, contributing to a optimistic and stress-free monetary life for all GPISD staff.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Galena Park ISD Payroll Calendar: A Complete Information for Staff. We respect your consideration to our article. See you in our subsequent article!